A massive loan write-off of Rs 9.9 lakh crore in the last five financial years has helped banks to show a big decline in non-performing assets (NPAs). Aided by this write-off, banks reported a 12-year low NPA ratio of 2.8 per cent of advances by March 2024.

Total recoveries from write-offs were only 18.70 per cent at Rs 1,85,241 crore in the last five years, according to the Reserve Bank of India data. This means banks were not able to recover 81.30 per cent, or over Rs 8 lakh crore of the loan written off in five years, despite adopting various recovery measures. These loan accounts were mostly wilful defaults with promoters and directors of some of the companies even fleeing the country. As gross NPAs reported by commercial banks were Rs 4.80 lakh crore as of March 2024, the total NPAs would be over Rs 12.80 lakh crore including the loans written off. The Finance Ministry last week said that the gross NPA ratio for scheduled commercial banks witnessed a significant reduction to 2.67 percent in June 2024 from 11.18 percent in March 2018. It was 11.5 per cent in March 2018 and 9.3 per cent (Rs 9.4 lakh crore) in March 2019.

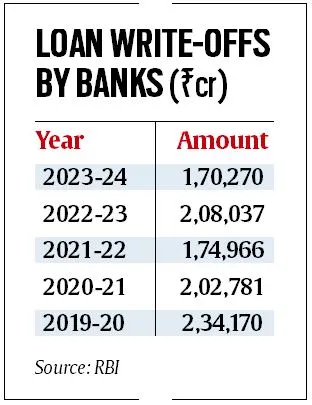

Banks were able to recover to recover Rs 46,036 crore in 2023-24 from loans written off earlier as against Rs 45,551 crore last year. Total loan write-off was Rs 1.70 lakh crore in FY24, Rs 2.08 lakh crore in FY23, Rs 1.74 lakh crore in FY22, Rs 2.02 lakh crore in FY21 and Rs 2.34 lakh crore in FY20, RBI data from an RTI reply shows. “Comprehensive steps have been taken by the Government and the RBI to recover and reduce NPAs from defaulters, which has enabled an aggregate recovery of Rs 6,82,286 crore by SCBs during the last five financial years,” Minister of State for Finance Pankaj Chaudhary said in the Lok Sabha.

“Such write-off does not result in waiver of liabilities of borrowers and therefore, it does not benefit the borrower. The borrowers continue to be liable for repayment and banks continue to pursue recovery actions initiated in these accounts through various recovery mechanisms available to them,” Chaudhary said. Once a loan is written off by a bank, it goes out from the asset book of the bank. The bank writes off a loan after the borrower has defaulted on the loan repayment and there is a very low chance of recovery. The lender then moves the defaulted loan, or NPA, out of the assets side and reports the amount as loss. “After write-off, banks are supposed to continue their efforts to recover the loan using various options. They have to make provisioning also. The tax liability will also come down as the written off amount is reduced from the profit,” said a banking source.

A loan becomes an NPA when the principal or interest payment remains overdue for 90 days. Public sector banks accounted for nearly 63 per cent of the write-off exercise.

“A major portion of this write-offs is due to technical/ prudential/ advances under collection. The banks retain the right to recover from the borrowers in all such cases,” the RBI said in an RTI reply earlier this year.

The nature and purpose of write-offs by banks is governed by several considerations. Once an account becomes NPA, prudential norms require the creation of provisions and on the basis of the aging of the NPA as well as the realisable value of security, these provisions get augmented and reach a stage where the provisions equal the outstanding in the account.

“So, once these accounts become fully provided, the bank is carrying an asset on one side and an equal provision on the other side. So, as a part of balance sheet management and for tax efficiency, the banks as per their Board approved policy resort to what is called technical write-off,” the RBI said in the RTI reply.

“Write-offs by banks is purely an accounting entry where an on-balance sheet item moves into off- balance sheet items and they are parked in typically what is known as ‘Advances Under Collection’ and there are specialised teams which follow-up for the recovery thereafter,” it said. The borrower’s liability to repay or the bank’s right to recover is not diminished in any manner, the RBI said.

According to the RBI, this is purely a balance sheet management. “Banks and regulators focus on such accounts that are parked in a special account to ensure higher recoveries because such recoveries go into aiding the P&L account and then contribute to the financial wellbeing of the bank,” it said.

“The percentage of recovery has to be seen in the context of the age of NPA and the availability or absence of security thereof. Bank management is expected to have approved policies for write-off and follow-up aimed at maximising recovery,” it said.

“The recovery process can take years. It’s spread over many years,” said an official of a nationalised bank. While many big and small defaulted loans were written off by banks over the years, the identity of these borrowers was never revealed by banks.

Why should you buy our Subscription?

You want to be the smartest in the room.

You want access to our award-winning journalism.

You don’t want to be misled and misinformed.

Choose your subscription package