An unprecedented rise in cyber crimes has gripped Mumbai, with citizens losing a staggering Rs1,181 crore in just 11 months this year — marking an alarming 350 per cent increase in such cases compared to that in 2023. More alarming is the trend of the frauds with a sharp rise in incidents of investment fraud, task job frauds and digital arrest in the first six months of 2024.

According to RTI data (till June 2024), while investment fraud or share trading fraud amount jumped nearly 25 times from Rs 7.76 crore in 2023 to Rs 191 crore till June this year in the city, the task job fraud amount stood at Rs 36.89 crore till June, as against Rs 40.77 crore in 2023.

On December 10, Minister of State for Home Affairs Bandi Sanjay Kumar informed the Lok Sabha that the Citizen Financial Cyber Fraud Reporting and Management System, launched in 2021 alongside the 1930 helpline for citizens to report online cyber crimes, had received over 9.9 lakh complaints nationwide since its inception. According to data from the Mumbai Police, 77,331 of these complaints — nearly eight per cent of the national total — were from Mumbai, a city that represents just one per cent of India’s population.

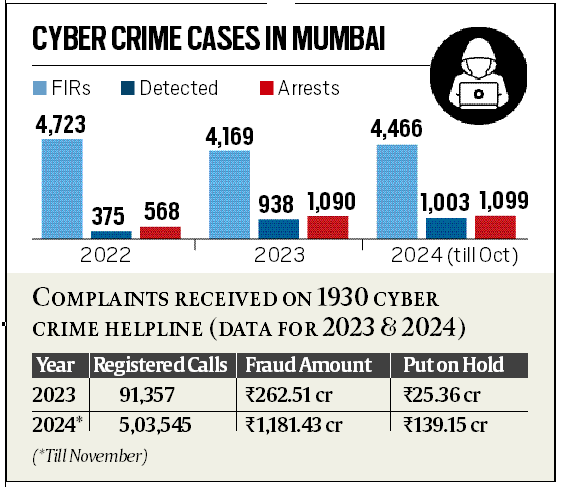

The 1930 helpline also has seen a significant increase in calls from the city. As of November 2024, over 5 lakh calls were made to the helpline, compared to just 91,000 calls in 2023. While not all of these calls were made by victims of fraud — many were from people who had been approached by swindlers but had not fallen victim — reports of actual losses have surged.

In 2024, by November, 55,707 victims reported losing Rs 1,181.43 crore, a three-fold increase from 2023, when 18,256 people complained of losing Rs 262.51 crore. Despite heightened vigilance and government campaigns urging citizens to report cyber crimes immediately, the recovery rate of stolen funds remains dismal. In 2024, only Rs 139.15 crore — 11.77 per cent of the total losses — was recovered, compared to Rs 26.52 crore (10.12 per cent) in 2023, despite significant resources being dedicated to tackling cyber crime.

Sources within the police department stated that the actual number of cyber crime cases and the amounts involved could be much higher, as the figures reported through the 1930 cyber helpline do not fully reflect the extent of cyber crimes affecting the citizens. Due to lack of awareness, many victims do not reach out to the helpline and instead report their cases directly to local police or cyber police stations. As a result, these cases and the amounts involved are not included in the data collected by the 1930 helpline.

Low recovery rate

Police officials attribute the low recovery rate in cyber crime cases to several factors, including delays in victims reporting the incidents, challenges in obtaining information from intermediaries and service providers, and the involvement of criminals operating from other states and even abroad.

“We have noticed that a significant number of individuals who approach us with complaints do not contact the National Cyber Crime Helpline – 1930 immediately. This helpline can play a crucial role in recovering lost money if contacted promptly. We are actively working to raise public awareness about its importance. Cyber fraudsters exploit human psychology, and even a moment of negligence can lead to substantial financial losses,” stated DCP Datta Nalawade, Cyber Crime, Mumbai.

In 2024, the 1930 helpline team of the Mumbai Police achieved success by saving more than Rs 150 crore of victims’ money. Additionally, the Mumbai Police blocked 6,500 suspicious mobile numbers in 2024, according to the DCP.

A senior police officer explained the factors behind the recent surge in cyber crime cases. “There has been a marked increase in cyber fraud gangs operating from various states such as Rajasthan, Delhi, Jharkhand, Madhya Pradesh, Odisha, West Bengal and Uttar Pradesh, as well as some foreign countries. These gangs meticulously research societal trends and adapt their methods to exploit vulnerable groups, particularly senior citizens or middle-aged individuals who lack technological expertise but have substantial savings in their bank accounts.”

As more essential services move online to enhance accessibility, convenience, and efficiency, fraudsters are quick to exploit these trends. “These criminals conduct thorough research on popular services and design scams targeting individuals in metropolitan cities. Greed and lack of awareness play a key role in their success,” the officer added.

Cyber expert Ritesh Bhatia offered a critical perspective on the rise of cyber crime cases. “While lack of awareness is often cited as the reason for the increase in cyber crime, those in power cannot merely claim that they are promoting awareness. Awareness programmes are not reaching every individual, and despite significant efforts, people continue to lose huge amounts of money.”

Bhatia emphasised that the lack of fear of the law is contributing to the rise in cyber crime. “The government must introduce stronger policies and amendments to cyber laws. Renaming the Indian Penal Code to the Bhartiya Nyay Suraksha Sanhita (BNSS) won’t suffice. The existing laws must be more effective in not only punishing offenders but also deterring potential criminals by setting strong examples,” he said.

Bhatia also highlighted the responsibility of authorities, including the police department, banks and social media platforms, in tackling cyber crime. “Rather than blaming victims for being unaware, the authorities should be held accountable. These platforms and systems are often exploited by fraudsters. If user security was prioritised over business interests, many cyber crimes could be prevented,” he added.

FRAUDSTERS ON THE PROWL

— Two kinds of cyber frauds that surged in 2024 — investment frauds and task job frauds

— In 2022 and 2023, investment frauds or share trading frauds worth Rs 3.87 crore and Rs 7.76 crore respectively were reported at 5 cyber police stations. This year till June month Rs 191 crore worth investment frauds were reported, reveals RTI data.

— Groups from other states target those who have newly started stock market investing or trading. Data of such vulnerable individuals are collected by floating advertisements or social media posts

— 15-20% victims of share trading frauds reported to cyber police stations are chartered accountants, leading bank managers, doctors, professors, serving and retired IAS, IPS and IRS officers, lawyers, etc.

— Job frauds or task frauds worth Rs 1.23 crore and Rs 40.77 crore were reported at 5 cyber police stations in 2022 and 2023, respectively. In 2024, till June month job frauds worth Rs 36.89 crore were reported

— Most of the job frauds reported were task job frauds, by defrauding people through “work from home” advertisements

— Digital arrest cyber fraud cases are surging in metro and tier two cities, prompting Prime Minister Narendra Modi to warn citizens against it

— Fraudsters operate from Rajasthan to Cambodia, Haryana to Indonesia, police say

— A cyber police officer said that cyber crime cases involving below Rs 15-20 lakh committed by gangs spread in Rajasthan (Bharatpur), Nuh/Mewat (Haryana), Jharkhand, West Bengal, etc., are generally through KYC update, task job frauds, power bill non-payment, ATM card suspension, UPI payments fraud, etc.

— Frauds involving huge amounts are through digital arrests, investment/share trading frauds, etc., by professional gangs operating from Cambodia, Indonesia, Myanmar, Dubai and Ajman, along with a few Indian groups. Call centres by international groups, controlled and operated by suspected Chinese nationals, force Indians, Pakistani, Bangladeshi individuals into carrying out cyber frauds in India, police say.

— A senior police officer said fraudsters use internet based calls and Virtual Private Network (VPN) to target people, making it difficult to trace them. Since mule bank accounts are used in the fraud, the money trail ends after a point.

— To dodge law enforcement agencies and vigilance of banking channels, fraud gangs use hawala operators to transfer money in US dollars in an eWallet. They convert money into USD to send it abroad by paying the taxes. Once the money crosses borders, it is gone.

— A cyber police inspector said that the responsibility also lies on the securities company whose names are misused on digital space for duping people. These companies should identify gangs impersonating their platforms and report them.

— After Covid-induced lockdown, investments in stock market, SIP-mutual funds and insurance, along with work from home culture gained popularity. Fraudsters saw big opportunity are taking advantage of two “weaknesses” of human behavior — greed and fear — police say.

‘BE AWARE, ALERT’

D Sivanandhan, former Maharashtra DGP: Cyber criminals and victims are spread all over the world. It’s almost impossible now to catch the criminals since they operate without borders. There are no international protocols in place between countries for cooperation and coordination yet. The government is issuing public awareness advertisements. But the number of crimes and the loss are growing day by day. The only way is to educate people. Think, pause and act is the only way to stop the crimes.

Datta Nalawde, DCP Cyber: Citizens must remain alert and vigilant. They should not fear fraudsters impersonating law enforcement officers, as there is no concept of digital arrest or detention in our legal framework. Instead of panicking, people are advised to approach police.

Akshat Khetan, cyber legal expert and founder of AU Corporate Advisory And Legal Services (AUCL): Citizens should stay alert and composed as scammers rely on anxiety and desperation. Around 6,000 complaints are reported daily on the National Cyber Crime Reporting portal with an average Rs 60 crore loss reported daily. Also, 1930 helpline received 60,000 calls daily, 3,700 fraud accounts reported per day and 35 per cent of reported amounts more than Rs 50 lakh. As India is moving towards a digitally empowered society, the risks posed must not be ignored.

Why should you buy our Subscription?

You want to be the smartest in the room.

You want access to our award-winning journalism.

You don’t want to be misled and misinformed.

Choose your subscription package