5 min read Last Updated : Aug 05 2024 | 11:34 PM IST

The financial markets in India and elsewhere on Monday were rattled by developments in the US and Japan, two of the world’s leading economies with significant ties to the global financial system.

Concerns about a potential recession in the US, driven by disappointing jobs data, and the unwinding of yen carry trades, prompted by an interest rate hike in Japan, triggered sharp reactions by investors across equities, bonds, and currencies.

The Sensex fell as much as 2,686 points, or 3.3 per cent, before ending the session at 78,759 — down 2,223 points, or 2.7 per cent than Friday’s close. Similarly, the Nifty 50 dropped 670 points, or 2.7 per cent, to close at 24,048. For both indices, this was the sharpest single-day decline since the Lok Sabha election results day on June 4.

The market rout resulted in a significant erosion of investor wealth, with a loss amounting to Rs 15.3 trillion. The total market capitalisation of BSE-listed companies now stands at Rs 442 trillion ($5.27 trillion), having decreased by over Rs 20 trillion over the past three trading sessions.

Government bonds, however, saw gains as they tracked the fall in US Treasury yields, according to market participants. The 10-year government bond yield settled at 6.86 per cent, the lowest since March 31, 2022, compared to 6.90 per cent on Friday.

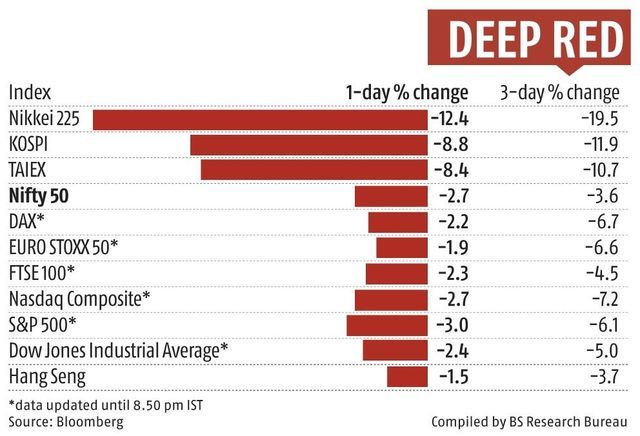

Despite the sharp decline in domestic equities, the fall was less severe compared to other Asian markets such as Japan (down 12.4 per cent), South Korea (down 9 per cent), and Australia (down 3.7 per cent). In Japan and South Korea, circuit breakers that automatically halt trading were activated to stem the bleeding. Wall Street’s main indices, too, were trading in the red in early trade.

Bitcoin, too, was down over 7 per cent to trade at $54,616.62 (at 9.30 pm IST), so as was Brent crude, which was trading slightly in the red at $76.37 a barrel.

Foreign portfolio investors (FPIs) sold shares worth Rs 10,073 crore, while domestic institutional investors (DIIs) were net buyers to the tune of Rs 9,156 crore. If not for the domestic buying support, the Indian markets might have witnessed a more severe collapse. Monday’s FPI net selling was the third-largest single-day outflow ever recorded and the biggest since June 4, 2024.

A US jobs report on Friday revealed a slowdown in hiring, with the unemployment rate rising to 4.3 per cent, the highest in three years, marking the fourth consecutive monthly increase. The rising jobless rate has heightened fears of an impending recession. Concerns about a slowdown in the US economy have intensified bets that the Federal Reserve might opt for an emergency rate cut or a 50-basis point reduction at its next meeting. Some market participants have also criticised the Fed for being behind the curve in easing monetary policy.

)

Analysts suggest that the sell-off in equities may become more pronounced as assumptions of a soft landing — which had underpinned recent market gains — come under scrutiny.

“We have moved from expectations of a soft landing to recession fears within a week. It can’t be that extreme. We need to see whether the Fed panics and takes quick action. Add to that the anxiety surrounding the unwinding of yen carry trades. The rout also shows concerns about the high valuations of US tech companies and earnings not matching up,” said Andrew Holland, CEO of Avendus Capital Public Markets Alternate Strategies.

The reversal of yen carry trades after Japan’s central bank raised interest rates also raises concerns about potential outflows from major equity markets. Carry trades involve investors borrowing from the markets with lower interest rates (Japan, in this case) to purchase higher-yielding equities and other financial assets in foreign markets.

“The yen has appreciated substantially, making carry trades a losing proposition that must be unwound. This can impact India, too, as we have substantial investments from Japanese investors, either directly or indirectly. Until there is some improvement in the global situation, one should not consider buying on dip,” said U R Bhat, co-founder of Alphaniti Fintech.

The Nifty VIX surged by 42 per cent — the most in nine years — to end at 20.4, indicating that investors are bracing for more volatility in the coming days. The CBOE Volatility index, also known as Wall Street’s “fear gauge”, breached its long-term average level of 20 points last week and was currently at 40.63.

“What the markets are saying is we want an emergency Fed cut and the Bank of Japan to reverse its policy, but central banks don’t act that quickly just because the markets are falling,” said Holland.

Market breadth was notably weak, with over five stocks declining for every advancing one on the BSE. All Sensex components ended in the red, except for FMCG giants Hindustan Unilever and Nestlé India. Tata Motors experienced the most significant drop at 7.3 per cent, followed by Adani Ports and Tata Steel, both falling over 5 per cent. All BSE and NSE sectoral indices closed with losses, with realty and metals indices witnessing the steepest decline of over 4 per cent each.

First Published: Aug 05 2024 | 11:34 PM IST